Planning for retirement can be challenging at any age, but it can be particularly daunting when you’re in your 60s.

With the beginning of a new chapter in life, you must ensure you’re prepared for the future. In this blog, we’ll explore helpful hacks to help you make the most of your retirement years. Here’s what you need to know.

Create a Retirement Plan

Starting a retirement plan sounds obvious enough, but 55% of Americans say they are behind on saving for retirement.

If you’ve hit the 60 mark, creating your own financial plan for retirement can be complicated because it will differ dramatically depending on what age you’d like to retire at — plus hundreds of other criteria that can be difficult to predict and will shift and change over the years.

Hiring a trusted financial advisor will help enable you to build a detailed plan, customized to your unique retirement needs and lifestyle preferences. The right advisor can provide you with a personal, straightforward and long-term approach to investing, focusing first on understanding your unique goals and then on developing diversified investment strategies designed to help you reach your goals.

By sitting down with a financial advisor, they can help also you with the following:

- Tax planning

- Estate Planning

- Lifestyle Management

- Investment Planning

- Money Management and more.

Remember, your retirement plan isn’t a one-and-done activity. As life evolves, so does your financial situation, so always make sure to reevaluate your plan regularly with your advisor.

Maximize Retirement Contributions

If you’re in your 60s and still in the workforce, it’s crucial to continue contributing to your retirement accounts, such as a 401(k) or IRA. At this stage, you may have fewer years left to save, and your retirement accounts may need an extra boost to cover your expenses in retirement. Fortunately, since you’re over the age of 50, you can make catch-up contributions to these accounts, which allows you to contribute more than the standard limit.

For 401(k) plans, the catch-up contribution limit for 2023 is $22,500, while for IRAs, the catch-up contribution limit is $6,500. These additional contributions help increase your retirement savings and ensure you have enough money to live comfortably during retirement. So if you’re in your 60s and still working, take advantage of catch-up contributions to maximize your retirement savings.

Consider Downsizing

As you retire, you may find your current home is too large or no longer suits your needs. Downsizing to a smaller house or apartment can provide many benefits. One of the primary benefits of downsizing is a significant reduction in housing expenses. Moving to a smaller home typically means lower utility bills, property taxes, and maintenance costs. This extra cash can boost your retirement savings or fund travel, hobbies, or other activities.

Another advantage of downsizing in your 60s is the opportunity to declutter and simplify your life. Moving to a smaller space requires evaluating your possessions and prioritizing what’s truly important. You may find that you’re holding onto items you no longer need or want, and downsizing can provide an opportunity to sell or donate them.

A smaller home or apartment may be more manageable, reducing the risk of falls and other accidents. Moreover, downsizing can make it easier to age in place. Plus, many smaller homes are designed with universal design principles, making them accessible for people of all ages and abilities.

Staying Healthy

Staying healthy is vital to a happy and fulfilling retirement. By taking care of yourself, you can ensure you have the energy and ability to enjoy your retirement to the fullest. Exercise is critical for your physical and mental health. Regular physical activity can help you maintain strength, balance, and flexibility, reducing your risk of falls and injuries. It can also help boost your mood and reduce your risk of depression and anxiety.

Finally, staying on top of your health concerns is essential during retirement. You can accomplish this by scheduling regular check-ups with your healthcare provider, taking your medications as prescribed, and following any recommended treatment plans.

Staying Connected

Staying connected with friends, family, and your community during retirement is essential. One way to stay connected is by joining local clubs or groups that align with your interests. Whether it’s a book club, a gardening group, or a fitness class, these activities can provide a sense of community and purpose. Plus, they can be a great way to meet new people and make friends in retirement.

Volunteering is another way to stay connected and give back to your community. You can choose to volunteer for causes you’re passionate about, such as a local animal shelter or a community garden. Volunteering can also provide a sense of fulfillment and purpose, which is vital during retirement.

Additionally, staying connected can help prevent feelings of loneliness and isolation during retirement. According to a report by the National Academies of Sciences, Engineering, and Medicine (NASEM), a quarter of adults aged 65 and older are deemed to be socially isolated. You can maintain a sense of belonging and purpose in retirement by prioritizing your social connections.

Prepare for the Unexpected

Although you can’t predict the future, you can prepare for it. Your financial advisor can help you plan ahead by including expectations for items such as inflation, market declines and health care so you can stay on track.

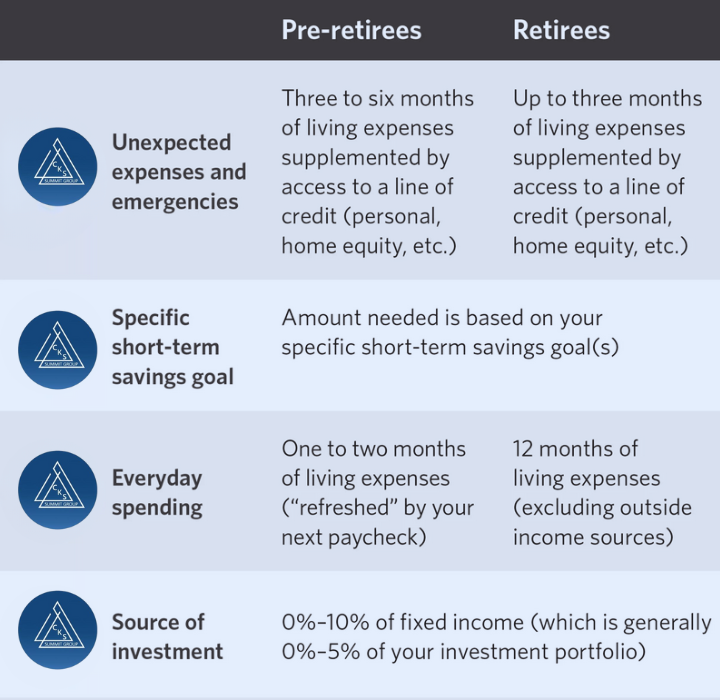

It’s also a sagacious move to bump up your emergency fund at this stage. Many uses for emergency cash in retirement are the same as they are before you retire with one key difference: You no longer have a steady stream of income from your full-time job. Broken appliances, house repairs or unexpected unemployment of your side gig can happen once you’ve retired. And don’t forget unexpected health expenses or dental work that insurance may not cover. How much should you have in your emergency fund?

Remember, these are estimates, so always consult with your financial advisor to gain a better perspective of your emergency fund target goal.

Final Thoughts

Even if you’re in your 60s, by taking advantage of some of these retirement hacks, you can be well on your way to retiring comfortably. At CKS Summit Group, we focus on bringing you fresh new ideas to help you expand your millionaire mindset. Our cutting-edge tactical portfolios help clients achieve safe, healthy savings growth and preserve their principal balance.

Are you ready to get started? Set up your complimentary strategy session here today.