The Federal Reserve is a major player in the US economy. But what exactly is the Fed? Who runs it? Who picks them? And how do they influence the economy?

Beginnings of the Fed

The Fed didn’t always exist. A long time ago, politicians were actually deeply divided on the issue of having a national bank. Some thought it would give too much power to the national government but others thought it was necessary to have one unified currency which was regulated by one central bank.

In the 1800s, the US had many independent banks with no one to really oversee their operations. Some presidents, like Jackson distrusted banks and blamed them for financial panics, and wanted to end banks altogether. Others saw the lack of regulation as the problem causing recessions. People would panic about the economy, and in their panic all would try to withdraw their money at the same time. The bank wouldn’t have enough money on hand, and people lost money.

These panics continued to happen, each time getting worse. As a response, in 1913 the government passed the Federal Reserve Act, and the Fed was born.

What is the Fed?

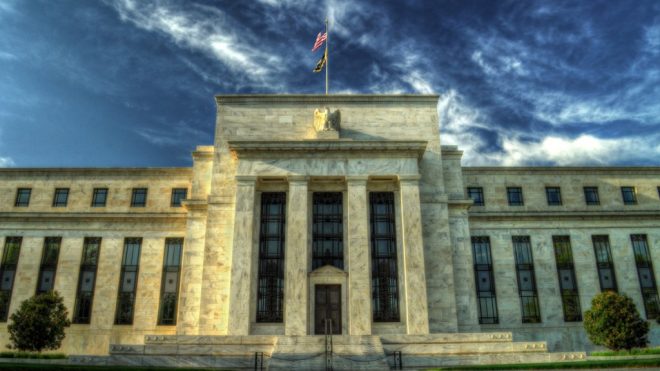

The Fed is the central bank of the United States. It is made up of a Board of Directors, appointed by the president of the US, and the Federal Open Market Commission (FOMC), and several regional branches.

The Fed is not elected by the people, nor does it work for the federal government. Congress does not have to approve what they do. They are completely independent in making their decisions.

So the goals of the Fed are to regulate banks and try to stabilize the economy by keeping steady inflation and unemployment levels.

What is their job?

First, the Fed regulates banks to try and prevent panics like the ones which happened in the past. They can change the requirement for what banks must hold in reserves at their bank. They also control the discount rate, which is the rate at which banks can loan to each other. The Fed is also the “lender of last resort” and can loan money to banks when necessary.

But their most important job is their open market operations. The Fed controls monetary policy, which can impact the economy in predictable ways. The Fed can expand or contract the money supply in the US economy by selling or buying US bonds. Changing the money supply changes the price level in the economy, which can affect unemployment levels. The other tool they have is their ability to change the interest rate. By setting the interest rate, they change the cost of borrowing money. When it is cheaper to borrow money, it is easier for everyone to get loans, and the economy expands.

So the goal of the Fed is to use these tools to stop the economy from growing too rapidly or crashing too hard. It is an incredibly difficult task. The economy has a ton of factors influencing it, and trying to read all the indicators and predict where the economy is headed is daunting. They must read where the economy is going and try to redirect it to a stable place. Add in the influence the an unpredictable global economy, and the task becomes one of the most difficult in the world.