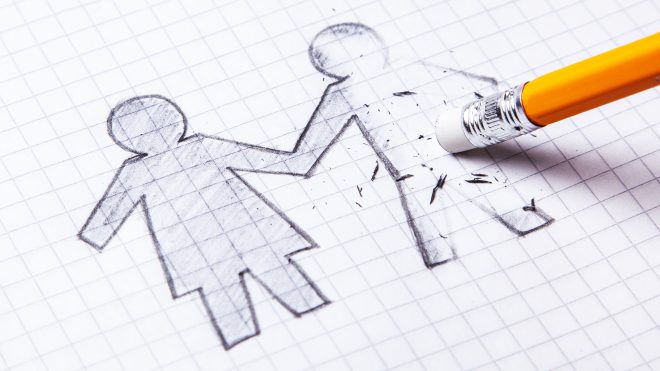

The emotional upset can be enormous when a spouse passes away. Decisions you make now will impact your future, so it’s important that you’re emotionally ready to start sorting through finances.

After you lose your loved one, let your emotions settle down a bit before making moves that could drastically affect your taxes and finances. Once you are ready, any decision you make, you should make sure to speak with a professional, such as retirement income financial planner.

Surviving Spouse Rights

As a widow or widower, you may have the right to part of your spouse’s pension. The money you are entitled to receive is called a survivor’s benefit. Whether you’re eligible to receive a survivor’s pension depends on each of the following factors:

- Where your spouse worked.

- When your spouse retired.

- When your spouse died.

- Whether you signed a written statement giving up or waiving your survivor’s benefits.

There are many mistakes you can make by rushing the process of getting your finances in check. The main financial hazards can cost you unnecessary taxes and possibly IRS penalties. Be sure to watch out for:

- Ignoring tax implications.

- Failing to plan for lower Social Security and annuity income.

- Taking unplanned withdrawals from tax-deferred accounts.

- Paying taxes on retirement account withdrawals too soon.

- Getting stuck paying a 10% early withdrawal penalty.

- Forgetting to take a required minimum distribution.

- Waiting to seek advice.

Looking Ahead

No one is ever ready, emotionally, for the death of a spouse. Losing a spouse can be devastating, whether the death is sudden or following a long illness. But you can prepare financially for the decision-making and reduced income you may someday face.

It isn’t always easy or realistic to focus on your finances shortly after losing a loved one. The best course of actions is often to avoid making any big money moves without advice. That’s where CKS Summit Group is here to help.

Expert Retirement Income Advice from CKS Summit Group

In today′s world, the importance of a well-executed retirement plan cannot be underestimated; especially when faced with the devastating loss of a loved one.

Our focus is to bring you fresh new ideas for your retirement income. Our cutting edge tactical portfolios help our clients achieve safe, healthy growth of their savings and preservation of their principal balance.

We design plans which are specifically structured to limit downside stock market risk. This allows us to protect our client’s assets while providing them with strategies for achieving effective tax reduction and inflation protection.

It all starts with a complimentary strategy session because we are most interested in what you want out of life. Asking the right questions enables us to offer retirement income options for you and your current situation.

Click here to set up your strategy session today.