The Social Security program’s costs are expected to exceed its income this year, marking the first time that has happened since 1982 and forcing the U.S. government to dip into the retirement system’s $3 Trillion trust fund to pay benefits to participants. The program’s trustees said the shortfall trend could worsen in the decades to come.

So what does this mean for beneficiaries? Without any changes, recipients would receive only about three-quarters of their scheduled benefits from incoming tax revenues. About 23 percent of older married couples rely on Social Security as their main source of income which could push some into poverty.

The report also said that Medicare’s hospital insurance fund would be depleted in 2026, three years earlier than anticipated in last year’s report. Absent changes, the program then would be able to handle 91% of costs.

Why is this occurring? The nation’s aging population is boosting the costs of Social Security and Medicare, while revenue gains lag due to slower growth in the economy and the labor force.

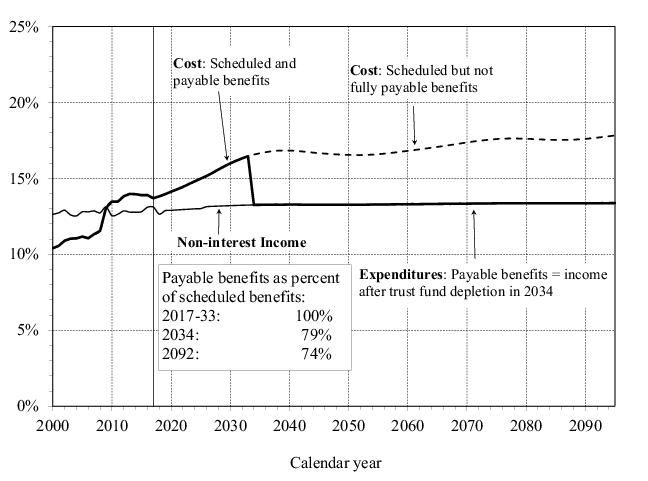

The below chart from the Trustees’ report shows what will happen after the combined trust funds are depleted in 2034, where all benefits to Social Security recipients at that time will be immediately cut by 21%, which is guaranteed under current law. That’s the promise that those who successfully fought Social Security reform nearly a decade ago fought to keep.

Congress has debated ways of bolstering the programs’ finances, but hasn’t agreed on what to do.

If you or a loved one are worried about the personal affects of the recent report, contact a retirement income planning specialist at CKS Summit Group. We’re here to work for you to protect you and your assets during this uncertain time.